By Dave Holman, MBA, Associate Broker – ReMax Riverside

On January 20th Dave presented the “Midcoast Maine Market Forecast” at the Maine Real Estate & Development Association’s (MEREDA’s) 2022 Annual Forecast Conference. Below is a recap from his presentation.

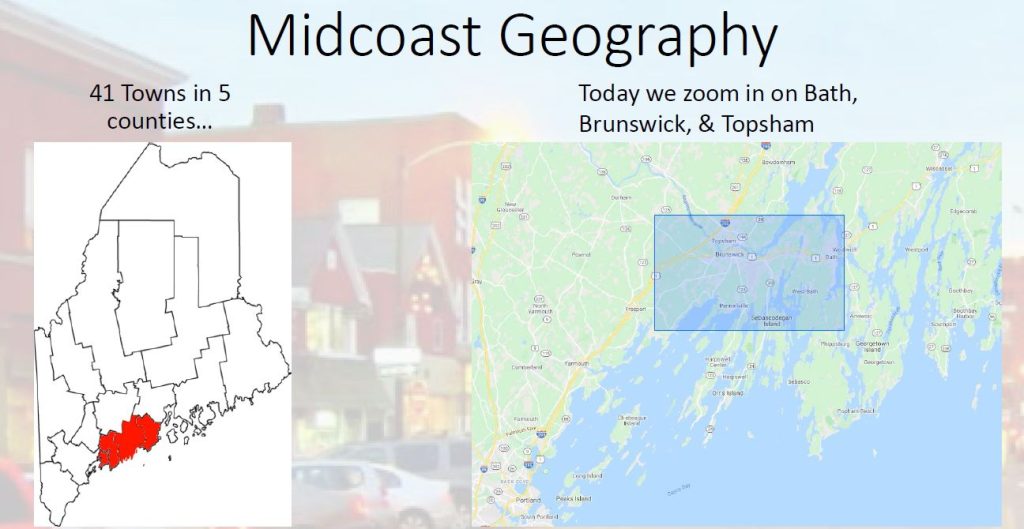

Midcoast Maine is having a moment. The triangle of Brunswick, Topsham and Bath experienced steady growth from 2014-2019, leaving the housing market hot, rents rising, new companies opening and jobs getting posted and filled by locals and non-locals alike. Then the pandemic hit and we collectively inhaled as we expected the sky to fall in both the economic and health realms. After much pain and even deaths on the health front, the economy has paradoxically boomed. 2020 and particularly 2021 witnessed an almost exponential expansion of job growth, construction and activity that the towns are racing to keep up with. In short, everybody wants to work and live here but there’s not enough room.

Let’s start with an amazing turnaround. The suburbanization of the 1950s-1980s gave way to urban renewal from the 1990s-2019. Portland went from the gritty port town of our youth to the foodie and condo mecca of today. The pandemic not only spurred an exodus from the cramped close quarters where outbreaks spread fast but also ignited a remote-work explosion where people kept their urban jobs but worked from pristine environments place like Merrymeeting Bay. Last year, New York State saw negative 1.6% population growth and Massachusetts saw negative .5% growth. People skedaddled the big cities. It will come as no surprise to you that Maine saw its highest growth in recent decades, up .7% in 2021. The urbanization trend in New England and nationally has turned on a dime, people are fleeing to so called “zoom towns” with high quality of life and this trend shows no signs of stopping in 2022.

We’ve all heard the bittersweet story of Midcoast residential real estate prices jumping up 21% last year, causing many locals to throw their hands up and many out of staters to plunk down cash offers. What you may have missed is that multifamily apartment prices are up an astonishing 48% per unit and commercial/industrial is up an eye-watering 64% year over year. This is not just cannabis growers and greedy landlord folks, this is genuine population pressure and job growth being poured into a small market with minimal construction over the past decade. Rents for a one-bedroom apartment that averaged $838 in 2018 stood at $1348 at the end of 2021, representing 62% growth in 3 years. The midcoast is experiencing an affordability crisis because new units are extremely expensive to build and slow to bring online.

But there’s good news too. Local governments are guiding growth into designated areas and establishing design and sustainability guidelines for new developments. The hot market is bringing exciting new opportunities to town like the new Martin’s Point facility in Brunswick, the new hockey rink and Market Basket in Topsham and a new River Walk in Bath. Bowdoin College is building Maine’s first ever mass timber (think modern post and beam made with laminated trusses) buildings that will reduce their carbon footprint by 75%. Entrepreneurs are bringing new businesses to town like Maiz, a Colombian street food restaurant and Animal House, an all-natural pet supply store. As this slice of the midcoast develops and expands, locals are focusing on quality, not quantity; preserving historic downtowns while renewing badly needed infrastructure like bridges and looking to see if the future stays hot or calms down.