by Richard Taylor, Research and Communications, MaineHousing

Building housing contributes to the quality of life in a community and its economy. Economic contributions are measured in jobs, wages, revenues, and increases in the overall value of products and services produced in a given area. In 2016, MaineHousing teamed up with the Maine Center for Business and Economic Research (MCBER) to examine the economic benefits of investments in Low Income Housing Tax Credit (LIHTC) multifamily housing construction to the economy.

MCBER, a US Economic Development Administration funded University Center located on the University of Southern Maine campus in Portland, Maine, provides strategic research and technical assistance to public and private organizations in Maine. Under the direction of Ryan Wallace, MCBER links University expertise with organizations to support economic prosperity for Maine’s residents and businesses. MCBER used the Regional Economic Models, Inc. (REMI) to analyze the economic impact of MaineHousing investment. REMI models are considered among the best available for estimating economic impact.

For this analysis MaineHousing provided MCBER with data on expenditures for new, rehabilitated, and reuse developments for 2015 and 2016. During that time MaineHousing and its partners spent $180 million on multifamily housing developments. With this investment, 29 multifamily buildings were created across 9 counties, totaling 1,119 affordable housing units.

With the expenditure data, the REMI model estimated:

- 1,430 jobs directly related to construction were created and another 1,016 were induced for a total of 2,446 jobs.

- The equivalent of 17% of average annual residential construction jobs were employed in MaineHousing developments, an employment sector that has yet to return to pre-recession levels.

- $74 million in wages and salaries were added to the economy.

- The economic output for private non-farm industries, state and local government, federal civilian, federal military, and farm sector economic activity was worth $259 million.

- $150 million in gross domestic product (GDP) was created as the expenditure made its way throughout the economy.

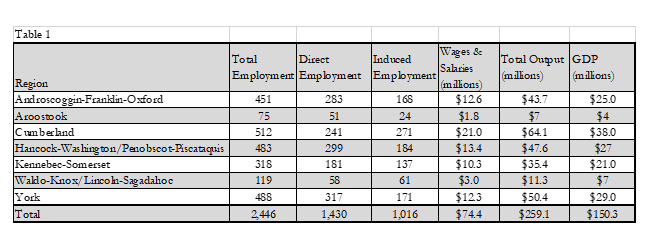

Table 1 below provides a breakdown of this economic impact by the seven regions used in the REMI model.

In addition to the employment and other economic benefits seen in Table 1, MaineHousing’s investments generated an estimated potential $1.4 million in municipal tax revenue spread across 21 municipalities.

Who is Employed?

MaineHousing’s contribution to the residential construction sector is important. The majority (59%) of those employed in MaineHousing’s developments work in occupations directly related to residential construction. At the outset of the Great Recession in 2007, this industry was hit particularly hard due to the collapse of the housing market. Between 2007 and 2010 the average number of residential construction employees dropped 29% or 1,567 workers from peak pre-recession level to the bottom of the recession. Only the information sector lost a greater percentage of jobs. Since 2010 some of these jobs have returned. MaineHousing developments have employed an estimated 17% (692) of average annual (2015 – 2016) residential construction jobs statewide.[1]

MaineHousing expenditures also generated jobs in other industry sectors, in particular the professional and technical fields. Of the 2,446 employed in MaineHousing developments 19% were professional, scientific, and technical services workers. Retail trade, health care and social service workers were employed indirectly and comprised 8% and 4% of the total employed. In total, MaineHousing’s investments support 19 different employment sectors.

Revitalization

Of the 29 housing developments financed by MaineHousing, 21 were existing structures either rehabilitated for continued use as a residential occupancy or an existing structure previously used for another purpose but renovated for residential use. These existing structures contain 78% of the affordable housing units built by MaineHousing in 2015 and 2016. In addition to the potential increase in tax revenue, the buildings are less costly to operate and safer due to upgrades that bring them into line with current building and life safety codes.

Affordable Quality Housing is Needed

MaineHousing’s investment in housing supports its core mission of assisting Maine people in obtaining and maintaining quality affordable housing and services suitable to their housing needs. In 2016, Maine’s median household income was an estimated $51,000. For renter households that figure was closer to $29,600. For renters to afford an apartment at the statewide average rent of $872 their income would need to be $34,800 in order to avoid being housing cost burdened (defined as paying in excess of 30% of household income). In 2016 there were an estimated 92,000 households that were cost burdened. That’s over half of the estimated 160,000 renter households in Maine or 37 times the units that were built as a result of MaineHousing’s 2015 – 2016 investment.

MaineHousing is a driver for affordable housing and the economy. As Ryan Wallace, Director at MCBER put it: “MaineHousing serves a critical need in the state supporting Maine families and workforce housing. But what these numbers demonstrate, is that not only is the organization addressing affordable housing challenges, their direct and leveraged investments are making a sizable economic impact in the form of jobs and income.”

[1] Maine Department of Labor, Center for Workforce Research and Information, Quarterly and Annual Industry Employment and Wages